Table of Content

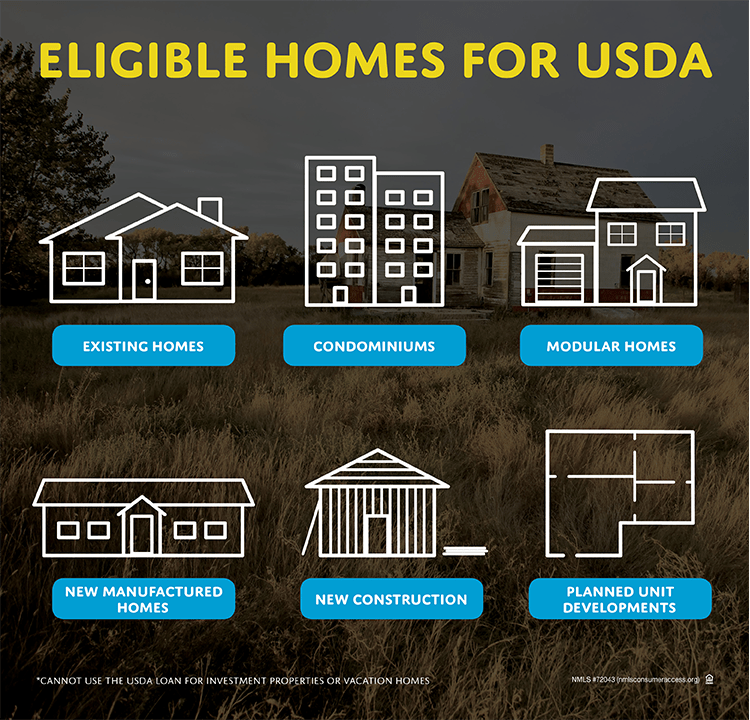

This list is not all-inclusive and not every applicant’s situation will fit perfectly inside these basic guidelines. In those cases, lenders may require an in-depth review of the applicant’s income against other determining factors to qualify. These are a little more difficult to find in rural areas though, so a house is generally the way to go. You can check to see if the condo you’re looking at isapproved here.

Here’s everything you need to know about USDA loans, and whether they’re right for you. Please select your state in the dropdown menu above to find your local contact for this program. Providing these affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. Utilizing the USDA Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas. Perhaps you need money to fix up the place once you have it.

USDA Loan Eligibility - USDA Homes

Officially called the “rural development loan,” USDA’s mortgage program is intended to promote homeownership in underserved parts of the country. And, USDA income limits are higher in areas where workers typically earn more. USDA Home Loan does not require a minimum credit score.

If you’re in the market for a mortgage, a USDA loan may be a viable choice, but there are certain guidelines all borrowers must follow. To get a USDA loan, you’ll typically need a credit score of 640 or higher. To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link. Traditional loans, otherwise known as conventional mortgages, are simply loans that are not backed by the US government. There is a difference, however, in the dynamic of a conventional loan vs. government-backed loan. For those who have a low to moderate income, this is often one of the best loan options available.

USDA Rural Development Increases Income Limits for Eligible Home Buyers & Homeowners

Even if a home has a small shed, it can stop its eligibility. The USDA is very picky about structures that exist on the property of a home. What they don’t want is for you to make money off of a property, which typically shows up when they look at your eligibility for a USDA loan.

It’s a zero-down loan — which means there’s no down payment required — and mortgage insurance fees are typically lower than those for conventional loans or FHA loans. Welcome to the USDA Income and Property Eligibility Site This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. To qualify for USDA home loans, you must first meet the eligibility requirements. Eligibility requirements include your credit score, income and statement of assets. The mortgage will be for a term of 30 years with interest rates that are comparable with any other 30 year government mortgage. Because of the terms of a USDA home loan, payment are lower than most other loans on the market today.

USDA Income Requirements

The USDA determines this factor by examining your employment, financial and credit history. However, you cant borrow more than the loan limit for the area you plan to live in. These mortgages are offered by private lenders that have been vetted and approved by the USDA, which then guarantees the loan. This, in turn, reduces the risk for lenders because if the homebuyer defaults on the mortgage, the government will pay the lender back.

Effective December 1, 2022, the current interest rate for Single Family Housing Direct home loans is 3.75% for low-income and very low-income borrowers. Let’s say you share a home with your spouse and a sibling. If all three of you are employed, the USDA will account for the annual income from all three people, even if you’re the only person applying. Beyond that, the USDA sweetens the deal by offering their loans with a $0 down payment from you. Direct loans come with low interest rates — three percent, as of December 2019.

Certified Loan Application Packager Resources:

For example, in Colorado Springs, Colorado, a household of one to four has a limit of $95,750. Now in Honolulu, a household from one to four has a limit of $144,740. What is a USDA direct loan versus USDA guaranteed loan? It’s about the USDA guaranteed loan, because it’s the most common type of loan. If you have a low household income and one loan for a rural property, you should check your USDA eligibility. Backed by the us government, USDA loans are actually similar to FHA loans and BA loans.

What are the usda loan income limits 2022, aUSDA rural development loan is intended for low to moderate income households. Now for 2022 annual household income generally should not exceed $91,900. And that’s for a five to eight member household, but that’s a general estimation. Now in truth, the USDA loan is set at 115% of the area’s media income amount, as well as differ.

This is the most stringent of all the USDA’s requirements for receiving a loan. You should first check if the property you want to buy falls within a USDA-covered area. The USDA developed these loans to help underserved areas and promote homeownership in the people who live there. And with just this background information in mind, you can probably guess some of the stipulations that come with a USDA loan. Rural areas are defined as not being a part of an urban area or open country.

Within the realm of income requirements, your credit score is also a key factor. Anything above a 620 should qualify depending on the lender. Some borrowers may qualify with a lower credit score, so it doesn’t hurt to talk to a lender if you meet the other qualifications. USDA loans are great for first-time home buyers in particular, as you don’t need any money saved up for the down payment.

For example, the largest increase for 502 Direct Home Loan income limits occurred in Seward, where a family of four can now make $77,200; an increase of $8,150 more than last year’s income limits. In Stanton, Pierce, Perkins, Otoe, and Fillmore counties the increase was more than $7,000 for each county. Just like any other mortgage, your loan amount will depend on several different factors. In addition to your income, your lender will look closely at your current debt and credit score. On top of that, you can use both guaranteed and direct funds to pay for your closing costs.

You will still qualify for a USDA loan if you don’t want to use the funds for, say, a down payment. You will still get one, so long as you plan to buy, repair, build or relocate a rural property. In general, though, both the direct and guaranteed USDA loans are only available for certain types of properties. To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. Simply stated, a USDA loan is a loan provided by the United States Department of Agriculture to expand upon rural development. The program means to helplow-incomeindividuals and families live a better quality of life in a home of their own.